Most corporates today strive to source as much of their power as possible from renewable energy sources, particularly because of global commitments like RE100 gaining traction. While rooftop or distributed solar is a great way to get started, many of our clients don’t have sufficient space within their facilities to install a power plant to supply the bulk of their energy requirements.

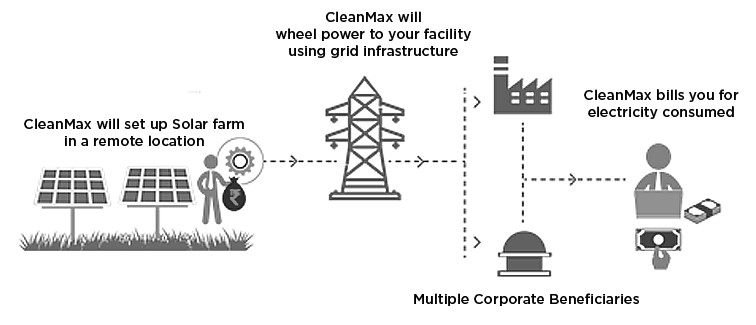

Grid-connected or ‘Open Access’ solar power through offsite Solar Farms addresses this problem by providing large-scale power through the grid, up to 100% of our clients’ needs. For instance, Adobe India, one of our open access clients, sources 100% of its power requirement for its Bangalore facility from our solar farms in Karnataka.

For a business, sourcing of renewable energy achieves the dual goals of substantial savings on electricity as well as making large strides towards 100% sourcing of renewable power. Open access solar power is a popular power generation option that gives enterprises like yours an opportunity to meet all your electricity needs at tariffs lower than the prevailing grid electricity rates along with the tariff certainty for next 20-25 years.

* Example:

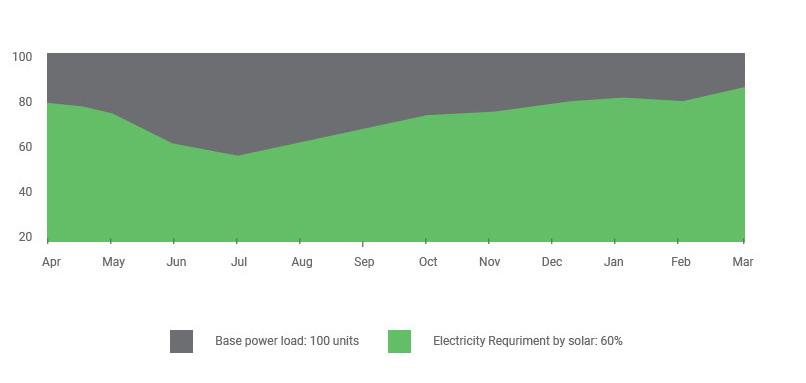

Below graph showcases the benefit of procuring power from offsite open access solar farms in India. The Solar power is supplied considering the Time of Year (TOY) and with banking restrictions prevailing in India.

Let’s assume that this large corporate has a need for a continuous and constant power load of 100 units throughout the year 24x7.

Then power procurement through an open access solar farm alone can cater to only 60 units i.e. for every 100 units of electricity required only 60% of the power requirement can be substituted by solar energy without the risk of incurring significant banking losses and also customer can achieve around minimum 25% savings on their annual electricity bills.

*Disclaimer: The information presented above is for educational purposes only. All the data provided in the article above are approximate values derived from third party sources, research articles or on ground experience and SSK Green Max would take no responsibility or have any obligation over the correctness of data.

Today we have a large network of private offsite open access renewable energy farms across India, through which we supply large corporates clean energy as per their requirements.

You can choose to procure low cost renewable energy using any of the below models.

At SSK Green Max, we can meet all your business electricity needs by supplying renewable energy from our offsite private Solar farms, Wind farms and Wind Solar Hybrid (WSH) Farms across India. Open access power tariffs are much cheaper than grid tariffs. Moreover, this model allows consumers to overcome the limitations of onsite solar installation, as it is a scalable option which is not constrained by availability of space at your facility. With open access power, you begin to enjoy affordable renewable energy from day one.

There are many reasons businesses like yours are considering renewable power over conventional power. For industrial and commercial consumers, open access power translates into regular electricity supply at a lower cost, while also helping reduce their carbon footprint.

Since this is an energy sale model, there is no upfront investment required from the consumer.

Electricity purchased from SSK Green Max will be at a tariff much lower than grid tariffs, resulting in energy cost savings on every unit provided.

With zero investment and upkeep responsibility, this is a capex-free, hassle-free, and risk-free solution.

By getting into a PPA with us, you will have fixed tariff for the next 20-25 years which is cheaper than prevailing grid electricity tariffs.

Contractual Challenges:

Operational Challenges:

Regulatory Challenges:

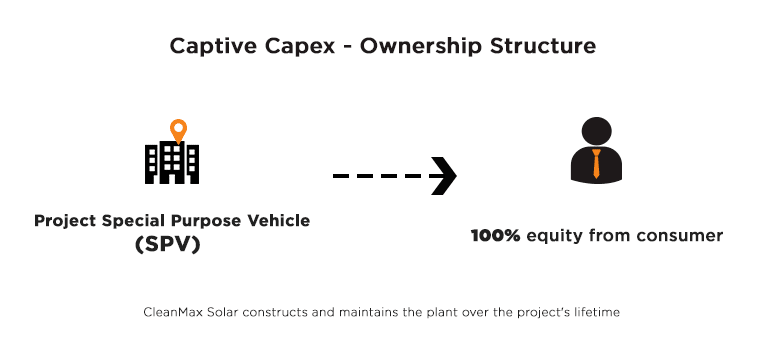

In the captive capex model, the corporate buyer for a utility scale renewable project makes the upfront capital investment. The buyer owns the power generating asset and the solar power generated is used for the corporate buyer’s self-consumption. SSK Green Max constructs the plant and operates and maintains it over its lifetime.

Open Access charges from the grid are applicable, but unpredictable charges, such as cross-subsidy surcharge and additional surcharge, are waived off in captive and group captive projects.

Under this structure, a corporate buyer who holds the asset on its balance sheet is also eligible to claim tax benefits through accelerated depreciation.

SSK Green Max will provide complete turnkey EPC solution while commissioning the plant with necessary regulatory approvals and due diligence. In addition, SSK Green Max will also operate and maintain the plant over its lifetime of 25 years.

The corporate buyer should ensure that a Group Captive project is fully compliant with the spirit of the law, and with the Electricity Act and the proposed amendments to the Electricity Rules by following two simple guidelines:

A variant of the captive model is the group captive model. Under the group captive model, a project is developed for the collective usage of one or many corporate buyers. SSK Green Max sets up a Special Purpose Vehicle (SPV) for group captive wherein the corporate buyer(s) holds only 26 percent of equity in a project and needs to collectively consume at least 51% of the power with the PPA. Here too, SSK Green Max will take complete responsibility for building, operating, and maintaining the project.

The corporate buyer can avail open access benefits of a group captive project without being required to completely own the project. Here, SSK Green Max will bear 74% of the investment – with the corporate buyer holding at least 26% equity. This is done to meet the ownership criteria that will allow exemption of cross-subsidy surcharge.

Even though the user is required to purchase electricity from SSK Green Max through a Power Purchase Agreement (PPA), it comes at much lower rates than prevailing grid tariffs, resulting in guaranteed savings on every unit consumed.

SSK Green Max will provide complete turnkey EPC solution while commissioning the plant with necessary regulatory approvals and due diligence. In addition, SSK Green Max will also operate and maintain the plant over its lifetime of 25 years.

The corporate buyer should ensure that a Group Captive project is fully compliant with the spirit of the law, and with the Electricity Act and the proposed amendments to the Electricity Rules by following two simple guidelines: